Deep Tech Briefing #42: 🏛 Pentagon’s Growing Ties to Silicon Valley; 🤖 Industrial Inspection Robot; 🧬DNA Storage; ☢️ Enriched Lithium Isotopes; 🛰 Constellation of Hyperspectral Satellites and more

An insider’s update on Deep Tech Ventures: Your dose of tech innovations, startups, exponential industries, policies, and market moves to stay ahead and capitalize on it.

Hey there! Welcome to the 42nd edition of Deep Tech Briefing, our Sunday column where we break down the week’s top developments in Deep Tech Startups and Venture Capital.

This is a free edition of The Scenarionist. To unlock our Premium Editions, designed to make you a better deep tech founder, investor, and technologist, click here.

Premium Members get exclusive access to strategies, tactics, and insights from exceptional investors and founders, as well as real-world case studies.

This Week’s Deep Tech Briefing: What’s Inside

⚡️Energy: From AI-Driven Fusion to U.S. Lithium Independence

🦾 Robotics: Industrial Inspection, Cognitive Automation, and Healthcare Innovations Surge

🧠 AI: From Sacks’ Deregulation to Microsoft’s M12 Bet on Generative AI Sparking Competitive Race

🛰️ Space Tech: AI Infrastructure, Hyperspectral Imaging, and Sustainable Propulsion

🧪 Advanced Materials: From Zero-Carbon Mining to Zero-Power Optics

🛡️ Defense Tech: Scaling Decision-Making and Tactical Superiority in a $3B Industry

🌐 Computing: Breakthroughs in Edge Silicon, DNA Storage, and AI Data Centers

✨ For more, see Membership | Partnership | Deep Tech Catalyst

⚡️Energy: From AI-Driven Fusion to U.S. Lithium Independence

This week’s developments in energy venture reflect a deepening interplay between emerging technologies, climate imperatives, and geopolitical undercurrents. At the intersection of clean energy and advanced materials, startups are redefining their industries while navigating regulatory shifts and market volatility.

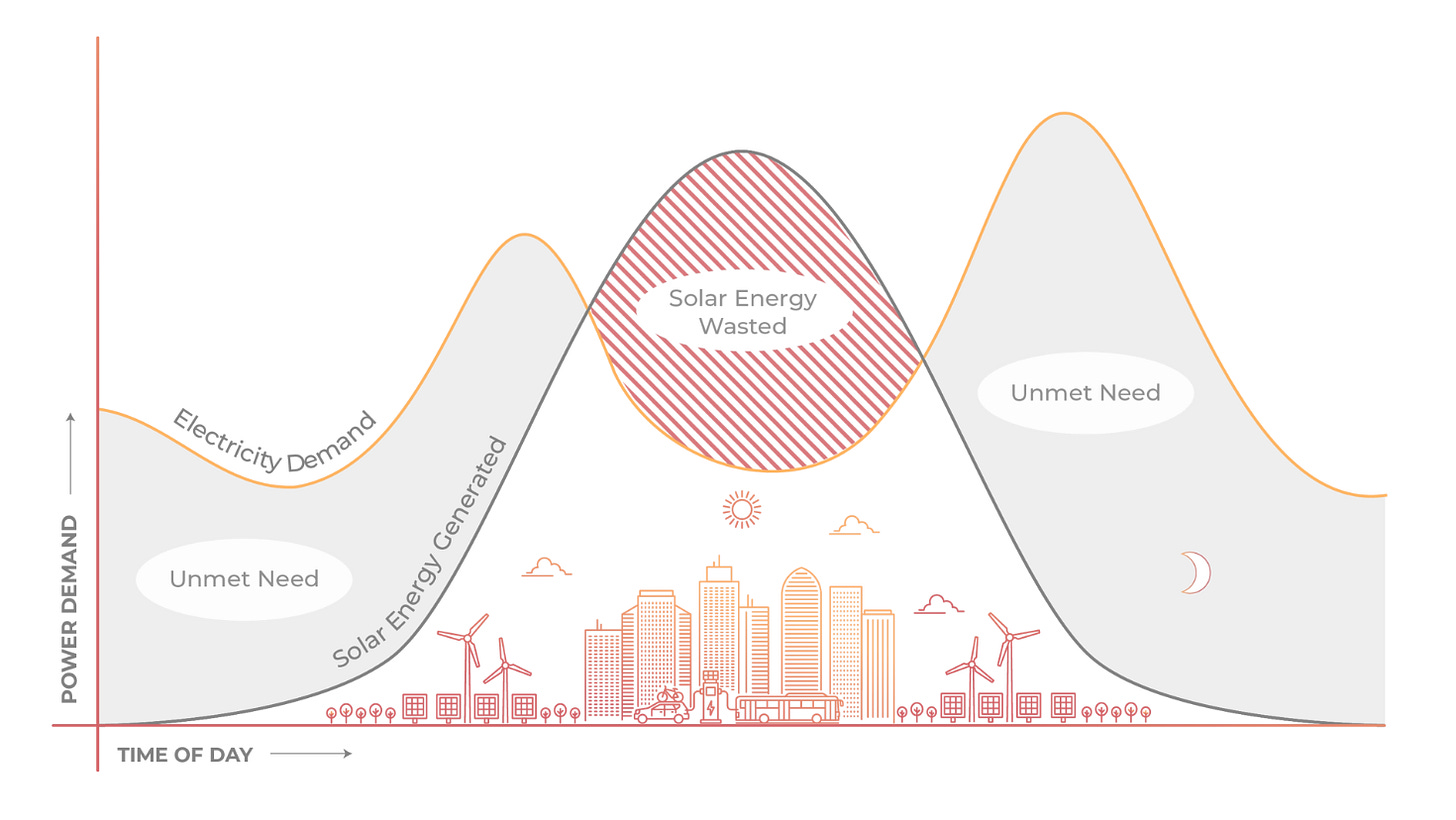

Take Skip Tech, the Portland-based battery startup that raised $5 million to advance its hydrogen bromine-powered grid-scale battery prototypes. These batteries, touted for their long-duration energy storage, aim to solve critical gaps in renewable energy infrastructure, particularly for data centers. Compared to lithium-ion batteries, they promise longer storage durations, reduced flammability, and the ability to source components domestically. While Skip Tech’s reliance on non-subsidized models offers resilience amid Trump’s climate policy rollback, scaling production to meet the demands of tech giants like Amazon and Microsoft will test their manufacturing and supply chains.

Meanwhile, nuclear energy—long a punching bag for environmentalists and a darling of futurists—is quietly gaining traction as a reliable source of large-scale (carbon-free) power. Aalo Atomics is moving forward with plans to build its experimental sodium-cooled microreactor at Idaho National Laboratory. With commercial deployment eyed by the end of the decade, the 10-megawatt Aalo-1 reactor could provide low-cost, carbon-free heat for industries like manufacturing and data centers. It’s a big promise for a small package, but nuclear’s stigma remains a hurdle. Public trust and regulatory approvals will be critical as Aalo navigates a sector where optimism often collides with entrenched skepticism.

Adding momentum to this nuclear resurgence is Molten Salt Solutions, which closed a $3 million seed round to develop a pilot facility for producing enriched lithium isotopes. These isotopes, vital for next-generation fission and fusion reactors, are currently sourced exclusively from Russia—a dependency that Molten Salt aims to disrupt. Using a novel liquid-to-liquid extraction process, the startup plans to produce both lithium-6 and lithium-7 domestically, enabling U.S.-based nuclear innovators like Kairos Power and Commonwealth Fusion Systems to secure a more stable supply chain. With the U.S. housing 25 of the world’s 45 private fusion companies, the demand for these materials is poised to soar, positioning Molten Salt Solutions as a linchpin in this burgeoning market. The company’s Santa Fe facility, expected to produce up to 1,000 kilograms annually, could become a cornerstone of America’s advanced nuclear supply chain.

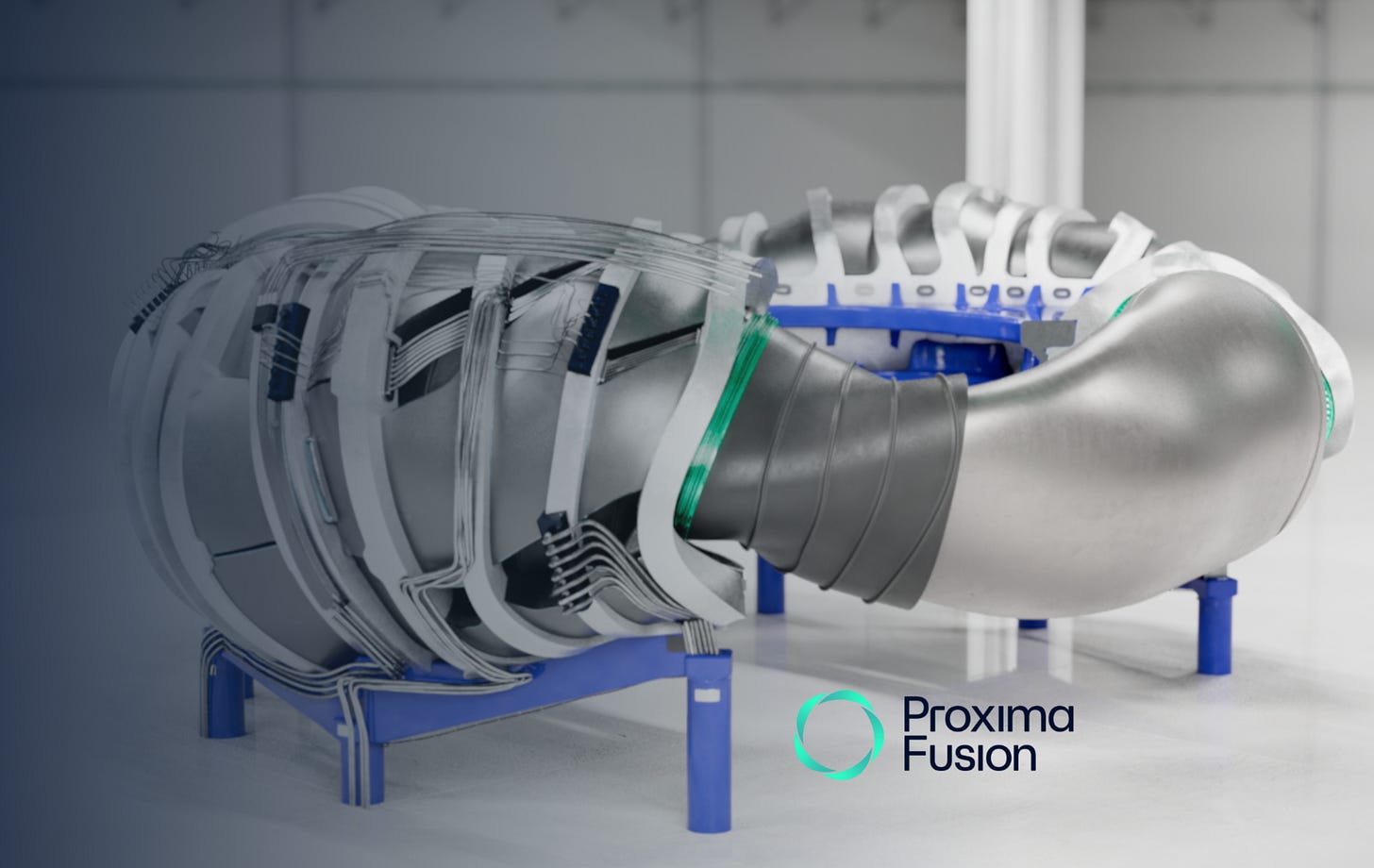

Across the Atlantic, Germany’s Proxima Fusion is leaning into AI to tackle the complexities of stellarator design, a promising but notoriously finicky pathway to fusion power. Armed with €6.5 million in government funding, Proxima is betting that machine learning can optimize the geometries of high-temperature superconductors and plasma-facing materials. This interdisciplinary approach underscores Europe’s commitment to fusion energy as a cornerstone of its energy transition. While fusion remains