2024 in Review: Deep Tech Startups & Venture Capital - Chapter 4

From Vertical Farms to Humanoid Robots

✨ HI There! This is a Free Edition of The Scenarionist. To enjoy the full experience, become a Premium Member!

The Scenarionist Premium is designed to make you a better Deep Tech Founder, Investor, and Operator. Premium members gain exclusive access to unique insights, analysis, and masterclasses with the wisdom of the world’s leading Deep Tech thought leaders. Invest in yourself, and upgrade today!

🌟 Reach New Heights in Deep Tech!

Master Deep Tech VC: Join our masterclasses and acquire the skills to excel in venture capital. From due diligence to value chains, we cover it all. Unlock Premium Access Now!

Connect with the Best: Join a global community of deep tech founders, investors, and operators. Showcase your startup or fund to a ready and engaged audience. Learn More!

Highlight Your Innovation: Building something revolutionary? Let us help you share your story and connect with the right partners and investors. Join Us Today!

👋🏻 Welcome to Chapter 4 of 2024 in Review: Deep Tech Startups & Venture Capital.

In this chapter, we unravel six pivotal themes that defined the intersection of technology, capital, and the future of industries:

Theme 11: Agrifood and Commodities

Theme 12: Reindustrialization—Dual Use as a Potential Catalyst?

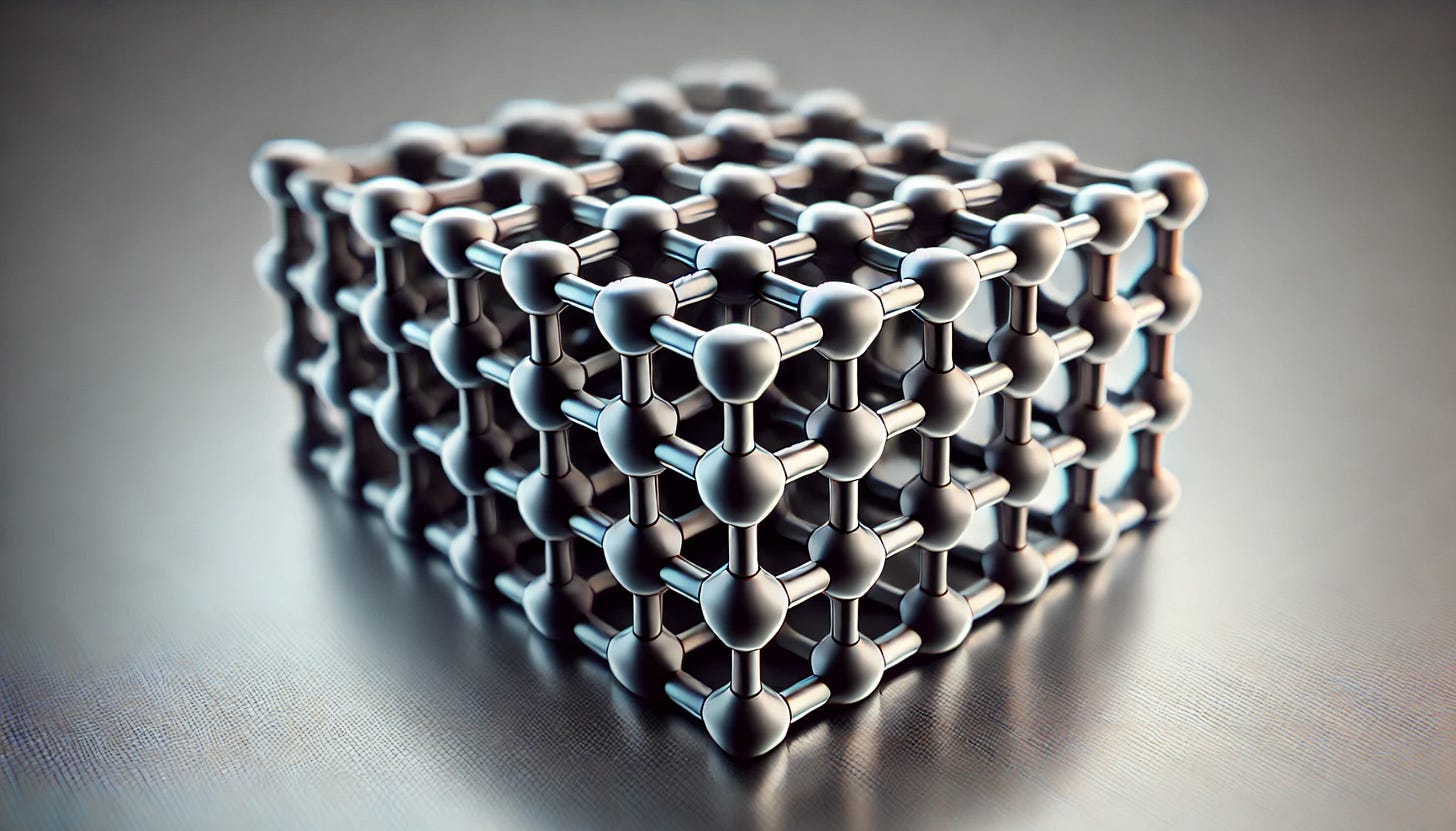

Theme 13: Advanced Materials for Advanced Industry/Manufacturing

Theme 14: Geopolitical Tensions & Tech Sovereignty

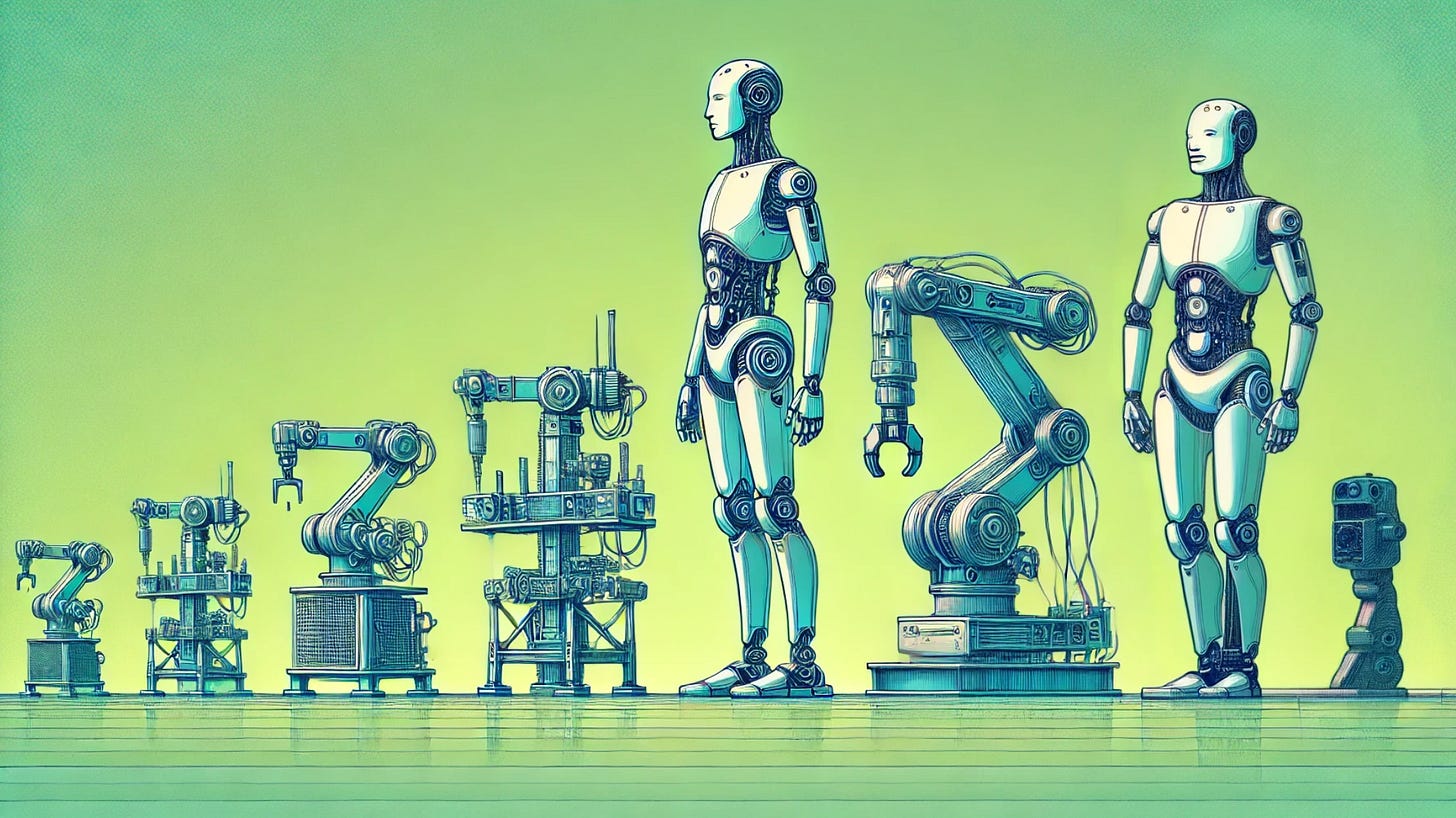

Theme 15: Robots—Shaping Manufacturing, Labor, and Human Interaction

Theme 16: A Cutting-Edge Mobility That Moves With Patience

At a time when technological innovation races to outpace climate volatility, geopolitical fragmentation, and economic restructuring, this chapter offers a lens into the transformative forces reshaping industries. From vertical “GigaFarms” promising scalable food production to the gritty realities of reindustrialization and the evolution of advanced materials, each theme reflects a larger narrative of resilience, sovereignty, and human ingenuity.

These themes don’t just reflect what happened in 2024; they signal where we’re headed. Agrifood is no longer a niche—it’s a lifeline in a world grappling with climate shocks and disrupted supply chains. Reindustrialization is rewriting the playbook for economic self-reliance, intertwining state-level incentives with dual-use technologies. Advanced materials—those unsung heroes of deep tech—are proving indispensable, underpinning breakthroughs across energy, manufacturing, and defense. Meanwhile, robots and mobility systems are redefining labor and infrastructure, all within the context of looming geopolitical tensions that shape not just markets but the very rules of engagement for technology.

Why This Matters

The narratives in this chapter are not isolated anecdotes—they are interconnected threads weaving a tapestry of challenges and opportunities. For deep tech founders, investors, and operators, understanding these dynamics is essential. Each theme provides insights into:

Scaling Complex Solutions: From vertical farming’s energy demands to the hurdles of industrial-scale advanced materials, the path from pilot to production is filled with lessons.

Navigating Geopolitical Currents: As tech sovereignty becomes non-negotiable for governments, startups and investors must think globally while acting locally.

Balancing Hype and Pragmatism: While AI and generative technologies dominated 2024, these themes remind us that foundational industries—from agritech to robotics—are where true resilience and impact are forged.

What to Expect

In the following pages, you’ll find a nuanced analysis of each theme, blending hard data with sharp observations. Expect thought-provoking case studies, such as Australia’s SwagBot redefining cattle ranching or the U.S.’s Slip Robotics pivoting from commercial logistics to defense applications. Anticipate candid explorations of “meltdown stories”, where ambitious ventures faltered, offering lessons for future resilience.

Prepare to be challenged: What does it mean to build in an era of fractured supply chains and heightened climate urgency? How do we balance technological innovation with ethical stewardship?

By the end of this chapter, you’ll not only have a grasp of 2024’s defining trends but also a toolkit for navigating the year ahead. Whether you’re an operator optimizing for scale, an investor seeking asymmetric bets, or a founder plotting your next move, the insights here are your compass in the evolving deep tech landscape.

So, dive in. The future of venture capital and industry isn’t just being imagined—it’s being built. And it starts here.

✨Theme 11: Agrifood and Commodities

For many, Agritech conjures images of vertical farms, lab-grown meats, and hyper-optimized supply chains—niches that can get drowned out by AI hype.

Yet 2024 was the year these “niche solutions” started looking like mainstream imperatives. A confluence of climate shocks, supply chain disruptions, and consumer demand for transparency thrust agrifood into new territory.

The result was a swirl of expansions, partial successes, and the occasional meltdown that reminded us how notoriously difficult it can be to scale something as complex as food production.

Vertical “GigaFarms” and Their Scaling Pressures

The most headline-grabbing example was the GigaFarm in Cobleskill, New York. At 387,500 square feet and armed with 100 vertical towers, the facility aimed to produce up to 3,000 tons of fresh produce annually, plus almost 700 tons from adjacent greenhouses.

The operation boasted a 33% cost reduction in indoor-grown greens compared to older vertical farms. Investors pointed to advanced sensor arrays, self-learning climate control systems, and on-site renewable energy integration as the secret sauce. The farm’s backers included big names in the local government, empire state initiatives, and private VCs who saw an existential need for secure, year-round food production.

But scale was—and remains—the biggest wild card.

Many smaller vertical farms folded under the weight of rising energy costs, local water regulations, or simply competition from these new mega-sites. The GigaFarm’s cost structure hinged on consistent electricity from renewable sources (and partial direct PPAs with advanced battery lines in the region).

Observers recalled how earlier vertical-farming darlings, brandishing “sustainable” labels, collapsed when the math of distributing produce across hundreds of miles negated any environmental or cost gains. By year’s end, GigaFarm was operational, though critics wondered if the industry’s “winner-takes-most” dynamic would push many mid-tier growers into acquisitions or bankruptcies.

Robot Ranchers and the AI Cattle

Australia’s SwagBot introduced the world to battery-powered cattle herding and real-time pasture analytics. The impetus was straightforward: vast ranches, labor shortages, and a push to reduce overgrazing. SwagBot’s owners claimed they could detect which patches of land were overutilized, steer livestock to fresher grasses, and minimize ecological damage.

Some ranchers found it life-changing—no more day-long rides to find cattle in remote corners. Others flagged the cost of adopting such technology, especially after seeing AI overshadow nearly every tech budget.

Even so, the synergy with “China-free” hardware was evident: certain big buyers insisted on verified local or allied components, so SwagBot scrambled to source motors domestically. The robot rancher phenomenon underscored 2024’s brand of “AI infiltration.” Even century-old cowboy traditions found themselves leaning on next-gen HPC analytics.

Transforming Commodities and the Invisible Fiber Movement

One of the quieter but telling expansions came from One Bio and other “invisible fiber” startups. These companies produce odorless, tasteless dietary fiber from agricultural or industrial waste streams.

The logic is crystal clear: People in wealthy nations undershoot recommended fiber intakes, while the planet drowns in sugar-laden processed foods. If you can seamlessly embed fiber in everyday items—snack bars, cereals, maybe even the breading on fast-food chicken—you address a real public health gap without forcing consumers to change habits.

One Bio’s $27 million in Series A capital might look modest in a year overshadowed by AI’s billion-dollar raises, but it signaled a pragmatic bet: bridging health needs with resource upcycling. Early pilot runs showed potential. Critics raised the usual scaling question: can they keep supply consistent if big names like Mondelez or Nestlé sign on? For now, investor sentiment was guardedly optimistic, buoyed by the alignment with consumer health and the broader sustainability narrative.

The Commodity Price Roller Coaster

Alongside these success stories, commodity markets continued whipsawing. Extreme weather events stunted yields in certain grain belts, forcing up prices for feed or cereals.

A handful of “AI-for-ag” platforms claimed they could mitigate that by predictive planting schedules or micro-targeted irrigation, but the overall effect on agrifood was a patchwork. If 2024 taught anything, it’s that climate volatility might be the single biggest wildcard.

For agritech solutions that offered resilience—vertical farms, advanced genetic seeds, or robotic herders—demand soared in climate-stressed regions. But for early-stage players trying to keep the lights on while the market flips from shortage to glut, it was a nerve-wracking ride. In short, agrifood found new fans who see it as critical infrastructure, but the sector remains littered with partial meltdown stories, from small vertical farms to mid-tier lab-based protein vendors overshadowed by bigger incumbents.

✨Theme 12: Reindustrialization—Dual Use as a Potential Catalyst?

If “China-free” was the policy mantra, “reindustrialization” was its strategic cousin.

The old manufacturing heartlands in the U.S. or certain parts of Europe spent decades offshoring. Now, 2024 saw a concerted push to bring at least some production back home—especially where advanced, dual-use technology could give both economic resilience and strategic advantage.

For many deep tech startups, hooking onto reindustrialization meant tapping into state-level incentives, bridging defense and commercial markets, or simply offering a cost-based approach that improved reliability over purely cheapest-labor models.

The Dual-Use Sweet Spot

One reason reindustrialization gained traction was the synergy with dual-use technologies—innovations that serve both civilian and military applications.

Some microreactor designs, for instance, promised off-grid power for remote communities but also for forward-operating military bases. Similarly, new advanced robotics solutions that can assemble EV parts might also be reconfigured for building, say, drone fuselages for defense.

Founders who pitched to funds with an open mind to “dual-use” found themselves better positioned, especially in the face of China tensions. The logic is that if you can sell to the DoD or allied governments, you reduce reliance on purely cyclical commercial demand. Or so the theory goes.

Real-World Examples

Darkhive: Already mentioned for advanced UAS in contested environments. They’re an emblem of how a small company can secure stable revenue by bridging commercial drone tech with specialized defense features.

Slip Robotics: The truck-loading solution that found new interest from Army logistics, given how quickly it can load/unload supplies in crisis settings.

Tidal Metals: Seawater magnesium extraction might eventually supply the Air Force’s advanced alloys for planes or the automotive industry’s quest for lighter EV frames.

The Caution: Manufacturing Is Hard

Even with subsidies, building or rebuilding factories from scratch is a monumental chore.

The meltdown story of Northvolt cast a long shadow—if a heavily funded battery champion can’t survive, who can?

Startups realized they might need to partner with established contract manufacturers or rely on smaller, modular expansions.

Some states in the U.S., like Michigan or Ohio, rolled out tax breaks for those who co-locate advanced manufacturing next to research labs. Still, the old pitfalls remain: high labor costs, supply chain friction, and local environmental boards with veto power.

For every founder who soared with reindustrialization, there was another forced to pivot or scale down. The pragmatic approach was to do partial domestic production, partial allied-nation supply, hoping that a hybrid was enough to appease “China-free” demands while maintaining cost competitiveness.

Where This Leaves 2024

Reindustrialization was less a single success story and more an evolving tapestry. Certain pockets, especially in defense-heavy states, saw a mini-manufacturing renaissance, aided by dual-use funding. Others found themselves stalled at pilot scale, overshadowed by AI mania or short on the capital needed for heavy industrial builds.

The net effect, though, was a revival of the notion that high-tech manufacturing isn’t just for Shenzhen or southern Germany. 2024 might, in hindsight, mark the pivot year when reindustrialization talks turned into partial real expansions.

✨ Theme 13: Advanced Materials for Advanced Industry/Manufacturing

The Unsung Backbone of Industry

Advanced materials are the unsung heroes of deep tech. While AI, quantum computing, and HPC dominate headlines and funding charts, advanced materials quietly underpin these innovations.

In 2024, breakthroughs in materials science enabled critical advancements across energy, aerospace, and defense. Solid-state battery electrolytes, high-temperature ceramics for microreactors, and metasurface optics for specialized drones all relied on these foundational technologies. Yet, despite their pivotal role, advanced materials remain largely overlooked in the venture capital landscape, with funding rounds rarely exceeding $40 million. While substantial within the materials sector, it pales in comparison to the billions flowing into AI.

This disparity underscores a "quiet crisis": materials science is essential but lacks the glamour to attract dominant investment.

Scaling lab breakthroughs into industrial production remains a complex and costly endeavor, but without these materials, the tech giants of HPC and AI would falter.

Rare Earth Recycling, Graphene, and Strategic Independence

2024 also highlighted the strategic importance of rare earths and local recycling. With geopolitical tensions rising and the meltdown of major battery projects, initiatives like Cyclic Materials gained traction.

By securing $53 million to scale rare earth recycling, Cyclic Materials demonstrated how advanced materials can address supply chain vulnerabilities. Similarly, Tidal Metals leveraged magnesium extraction from seawater to sidestep environmentally damaging and internationally dominated mining processes. This innovative approach aligns with the broader industrial autonomy narrative driving technological policy.

Graphene and metasurface coatings also showed promise. Startups like Imagia, which revolutionizes zero-power image processing, offer transformative solutions for power-constrained devices like AR glasses and wearables. By shifting tasks such as gesture recognition and face detection from chips to optical filters, Imagia eliminates latency and drastically reduces power consumption, positioning itself as a potential cornerstone for next-generation devices. With Google AR exploring its capabilities, the commercial promise is evident.

Breakthroughs in Fiber Technology

New fibers have emerged as a critical area of focus, bridging aerospace, defense, and automotive applications. FibreCoat, a German startup, exemplifies the sector’s potential. By coating fibers with metal or plastic during spinning, FibreCoat delivers lightweight, conductive, and durable materials at a fraction of current costs. Their recent €20 million Series B funding positions them to capitalize on the $1.8 trillion space infrastructure market projected by 2035.

Meanwhile, Mitsubishi Chemical’s $13.5 million investment in Boston Materials underscores the growing competition in advanced fiber innovation.

Boston’s "Z-axis" carbon fiber technology redefines mechanical properties by enhancing connectivity in neglected directions, meeting critical demands for lightness and strength in the aerospace and automotive sectors. Beyond this, startups like Aridditive are pushing boundaries with 3D concrete printing, reducing construction waste while enabling structures unfeasible with traditional methods. Collectively, these breakthroughs reflect a profound shift in how industries are leveraging material science to solve long-standing challenges and redefine efficiency.

From Rockets to Defense: Real-World Applications

Advanced materials are quietly revolutionizing critical industries, solving tough problems in aerospace, defense, semiconductors, sustainability, and beyond. Companies like Oros Labs are leading the charge with innovations like Solarcore, a polymer-based aerogel originally inspired by NASA’s insulation technology. Lightweight, scalable, and incredibly effective, Solarcore is already deployed in tactical shelters for Arctic military operations and gear for zero-gravity experiments. With $22 million in funding from Airbus Ventures, OROS is proving how practical materials innovation can transform performance in extreme environments.

In semiconductors, U.S.-based Thintronics is disrupting a market long dominated by Japan’s Ajinomoto, which controls 90% of the dielectric film used for micro-component insulation. Thintronics’ advanced materials promise faster computing speeds and lower energy consumption for AI-driven technologies, and federal initiatives like the CHIPS and Science Act are fueling their growth. If successful, their innovations could redefine semiconductor supply chains, a critical step in reducing reliance on foreign materials.

Sustainability is another frontier for advanced materials, with companies like Carbios leading the way. Using an enzymatic process, Carbios has developed a method to recycle mixed polyester fabrics—a challenge traditional recycling methods can’t solve. Their plans to scale up to a 50,000-ton industrial plant by 2026 could significantly address the 86% of polyester that currently goes unrecycled. However, the cost gap between recycled and virgin polyester remains a hurdle that will likely require regulatory support to overcome.

In aerospace, Raven Space Systems is leveraging 3D printing to produce thermoset materials for hypersonic vehicles and other critical components. This approach reduces production times from months to days, offering a major competitive advantage in defense and space sectors where precision and speed are non-negotiable. The global market for additive technologies in aerospace is expected to reach $6.5 billion by 2030, and Raven is positioned to be a key player.

Meanwhile, iMicrobes is rethinking chemical production with a process that converts methane—a greenhouse gas 80 times more potent than CO2—into biochemicals. By offering a sustainable alternative to petrochemical-based products, iMicrobes could transform markets like acrylic acid, valued at $12 billion globally. Their dual approach of environmental mitigation and market-ready chemical production signals a new model for scalable green technology.

Even the luxury market isn’t immune to disruption. Paris-based Faircraft is transforming the $80 billion leather industry with lab-grown leather. By bypassing traditional supply chains and the environmental challenges of livestock-based leather, Faircraft’s cellular biotechnology offers a stable and high-quality alternative. The question is whether high-end buyers will absorb the premium costs of these biomaterials, which currently outpace traditional leather prices.

These companies show how advanced materials are solving complex problems, often in overlooked niches. From enabling hypersonic travel to redefining recycling, advanced materials are quietly building the infrastructure for the industries of tomorrow. It’s not just about flashy tech—it’s about practical solutions that tackle today’s challenges while laying the groundwork for a more sustainable, efficient, and innovative future.

The 2025 Outlook: Slow but Essential Progress

Scaling advanced materials from lab discoveries to industrial production remains a formidable challenge. The trials of companies like Northvolt highlight the critical need for substantial capital, strategic partnerships, and a clear path to industrial scale. Looking ahead to 2025, industry analysts predict a steady, deliberate expansion for the sector, driven by the imperatives of reindustrialization, Industry 4.0, and the global demand for secure, resilient supply chains.

Advanced materials are not merely supplementary; they are the essential infrastructure of modern industry. While AI and quantum computing capture attention and investment, advanced materials quietly provide the foundation for these technologies to thrive. Whether enabling next-generation semiconductors, sustainable manufacturing, or lightweight aerospace innovations, these materials sit at the intersection of durability, efficiency, and innovation.

Yet this industrial progress hides a stark reality: without a significant infusion of funding and prioritization, the breakthroughs of today may fail to reach the factories of tomorrow. The slow pace of industrial adoption risks creating bottlenecks in supply chains, undermining the very sectors that depend on these materials to innovate.

The question for 2025 is clear: Will we treat advanced materials as the backbone of the industry they are, committing the resources and attention required to scale them? Or will their potential languish, leaving critical sectors underprepared for the demands of a more complex, interconnected, and competitive industrial era? The answer will define not just the trajectory of advanced materials but the future of global manufacturing itself.

✨Theme 14: Geopolitical Tensions & Tech Sovereignty

We touched on Sino-Western friction in earlier themes, but 2024 took “tech sovereignty” to new extremes. The EU’s €11 billion Iris² constellation was one piece; the U.S. restricting advanced HPC chip exports was another. Meanwhile, China formed new standard-setting bodies for AI, quantum, and advanced robotics.

The upshot? Every deep tech founder realized the old notion of a globalized supply chain might be cracking.

The Battle Over Standards and Protocols

AI might be the prime battleground. If you’re building a foundation model for enterprise or HPC-based generative solutions, you face critical questions: whose regulations do you abide by?

Do you design your system to be flexible for EU privacy laws, U.S. compliance demands, or a possible Chinese censorship protocol?

Similar tensions arose in quantum encryption, where the side that sets cryptographic standards effectively controls secure communications for a generation. For smaller startups, it’s a puzzle: adapt to multiple regions at once or pick a side. Larger players like OpenAI or Databricks also found themselves negotiating official channels or local boards.

Tech sovereignty here isn’t just an abstract policy stance; it dictates which HPC resources you can use and which cross-border deals get the nod.

Splinternet for Deep Tech?

The concept of a “splinternet”—fragmenting rules around data flows and digital services—crept into hardware. We saw “drone-splintering”, “battery-splintering”, and “HPC-splintering”.

Orqa in Europe was building a 100% EU supply chain for UAVs.

U.S. defense demanded a 100% American chain for certain advanced robotics or microelectronics.

Chinese suppliers pivoted more to non-Western clients.

The year 2024 ended with a sense that globalization had peaked for certain advanced domains, replaced by a patchwork of sovereignty zones. If you’re a founder with a new sensor or AI chip, you might choose to remain neutral, but eventually you’ll be forced to pick which market’s compliance you chase first.

Observers worry about redundancy and inefficiency: each zone building near-identical but slightly incompatible solutions. For others, it’s a necessary cost to reduce external dependencies.

The Market’s Reaction

Investors that once prized “global scale from day one” recognized the friction. Some started writing dual region strategies or insisted their portfolio companies incorporate the cost of parallel supply lines. The meltdown stories in advanced manufacturing taught many that ignoring geopolitics is a lethal mistake.

Meanwhile, big winners were those with the political savvy to secure deals from allied governments. For better or worse, the future of deep tech at year’s end looked to revolve around forging or severing supply ties based on these intensifying tensions.

✨ Theme 15: Robots—Shaping Manufacturing, Labor, and Human Interaction

In 2024, robots cemented their status as essential players in reshaping global manufacturing, logistics, and even healthcare. While humanoid robots captured headlines, the quiet yet profound advances in industrial automation revealed the true potential of robotics to address systemic challenges like labor shortages and supply chain bottlenecks. Startups and established players alike focused on making robotics not just smarter, but more integrable, efficient, and accessible.

Industrial Robotics: Modular and Adaptive

Robotics is transforming industries on multiple fronts, showcasing adaptability and innovation in logistics, energy, and manufacturing. Companies like Ambi Robotics lead the charge in warehouse automation with AI-driven solutions, while Slip Robotics’ SlipBots revolutionize supply chains by cutting truck-loading times from hours to minutes, securing $28 million in Series B funding. In energy and infrastructure, automation pioneers like Built Robotics use robots to accelerate solar farm construction, a crucial step as the International Energy Agency projects a doubling of global solar capacity by 2030. Similarly, in the EV market, Autev’s autonomous charging robots offer flexible alternatives to traditional infrastructure, turning parking spots into charging stations with a competitive pricing model that avoids costly upgrades.

In heavy industry, Swiss robotics company ANYbotics secured $60 million to scale its quadruped robot, ANYmal, already deployed by companies like BP and Equinor. ANYmal autonomously inspects oil rigs, monitors gas leaks, and builds 3D models, addressing a $100 billion industrial inspection market projected by 2030. Similarly, Eureka Robotics raised $10.5 million to enhance its High Accuracy-High Agility (HA-HA) systems, addressing precision manufacturing challenges. Backed by Airbus Ventures, their expansion into the U.S. could disrupt the $140 billion precision manufacturing market, solidifying robotics as an indispensable force in reshaping industries.

Moreover a standout in Robot Training Systems is Swiss-Mile, a spin-off of ETH Zurich. Combining neural networks with hybrid robots equipped with legs and wheels, these machines autonomously navigate urban environments. From disaster relief to logistics, their versatility attracted a $22 million seed round led by Jeff Bezos’ Bezos Expeditions, showcasing the transformative potential of cognitive robotics.

Humanoid Robots and Ethical Quandaries

The rise of humanoid robots introduced ethical complexities that the industry can no longer ignore. Robots designed to look and behave like humans, such as Tesla’s Optimus, blur the lines between tools and companions. While these machines promise breakthroughs in healthcare, customer service, and even elderly care, they also raise concerns about privacy, surveillance, and the erosion of human labor.

As humanoid robots become more socially adept, questions about how much autonomy they should wield have sparked debates among policymakers and ethicists. For example, what happens when a humanoid robot designed for elder care begins to make decisions that affect a person’s health?

Labor Shortages and the Case for Collaborative Robots

Labor shortages in agriculture and manufacturing have accelerated the adoption of collaborative robots (cobots)—machines designed to work alongside humans, boosting productivity without fully replacing jobs. In Germany, Neura Robotics is setting the pace with cognitive cobots that can see, hear, and adapt in real time, merging cutting-edge engineering with a startup-friendly approach.

In agriculture, the race is on. Four Growers raised $9 million to scale its GR-100 robotic harvester, which operates five times faster than human workers with 98% accuracy. However, the hardware game is tough.

Failures like the Small Robot Company remind us that scaling requires more than innovation—it demands funding, partnerships, and a razor-sharp focus on cost efficiency. Four Growers’ collaboration with Syngenta gives it an edge, but competitors like Agrobot and Root AI are pushing hard.

Meanwhile, in recycling, AMP Robotics raised $91 million to revolutionize sorting, tackling a $32 billion opportunity in recoverable materials. In energy, startups like Planted Solar and Built Robotics are slashing solar farm construction times with automation, cutting timelines from a year to four months. Robots that adapt to uneven terrain could even shrink land requirements, paving the way for more compact installations.

✨Theme 16: A Cutting-Edge Mobility That Moves With Patience

The Green Promise and Market Realities

The electric vehicle (EV) industry, once heralded as a symbol of the green transition, faced a sobering reckoning in 2024. As the sector matured, market realities—declining investor confidence, scaling challenges, and geopolitical uncertainties—exposed the vulnerabilities of even its most celebrated players. High-profile bankruptcies like Northvolt, Fisker, and Arrival underscored the precariousness of scaling capital-intensive businesses, while a broader attrition loomed over the ecosystem.

According to a Wall Street Journal analysis, 75% of operational EV startups are hemorrhaging cash, with 13 at risk of depleting funds by mid-2025. This Darwinian winnowing, while painful, may ultimately refine the sector, favoring startups with robust business models and defensible technologies. However, collapsing stock prices and a faltering consumer appetite for EVs cast a shadow over the industry's ability to maintain its upward trajectory.

Geopolitical Shifts and Supply Chain Dynamics

Layered atop financial turbulence were geopolitical currents reshaping the EV landscape. The re-election of Donald Trump brought with it policy shifts that threatened to derail domestic innovation. His administration's proposed revocation of the $7,500 EV tax credit and tariffs on imported auto components could inflate costs, disrupt supply chains, and deter investment in U.S.-based manufacturing.

Meanwhile, Chinese juggernauts like BYD and CATL fortified their positions as global leaders, leveraging economies of scale, vertical integration, and substantial government support. Their dominance in battery production further accentuated the competitive gap, challenging the West's ability to maintain technological leadership in the EV space.

In response, the European Union intensified efforts to reduce reliance on Chinese imports, announcing €1 billion in subsidies for electric vehicle battery cell manufacturing. While this reshoring strategy signals a strong commitment to supply chain resilience, questions remain about whether Europe can achieve cost competitiveness and drive true innovation rather than simply shielding incumbents.

Innovations Amidst Adversity

Despite the mounting challenges, innovation continued to be the lifeblood of the EV industry. Zeno, for example, is taking a Tesla-like playbook and rewriting it for Africa and Southeast Asia, where two- and three-wheelers dominate. With $9.5M in fresh funding, they’re tackling the trifecta of cost, infrastructure, and energy reliability by pairing EVs with renewable microgrids.

At the same time, Crisalion Mobility is thinking vertically—literally. Their Integrity eVTOL scored a 10-aircraft deal with Air Chateau, marking Dubai as a launchpad for sustainable air taxis. And then there’s Kite Mobility, turning Canadian cities into testbeds for shared EV hubs that could kill car ownership as we know it.

By reimagining personal vehicle ownership, Kite proposes a more efficient, sustainable, and economically viable urban mobility model. Early adoption rates in Canadian pilot programs suggest that the appetite for such paradigms exists, particularly as urban centers grapple with congestion, housing density, and the mounting costs of parking infrastructure. For real estate developers, such solutions present a compelling alternative: why invest millions in parking structures when mobility hubs could serve residents’ needs more efficiently? :)

The Up and Down of Vertical Mobility

While electric vehicles (EVs) continued to dominate terrestrial headlines, 2024 marked a pivotal year for vertical mobility, as the nascent eVTOL (electric vertical takeoff and landing) sector navigated both promise and peril. These futuristic aircraft, heralded as the vanguard of urban air mobility, promise to redefine transportation by blending sustainability with cutting-edge aerodynamics—but the journey from concept to reality remains fraught.

Crisalion Mobility stood out as a rising star (as we saw before). Their Integrity eVTOL, featuring proprietary FlyFree technology, secured 125 pre-orders, including a 10-aircraft deal with Dubai-based Air Chateau. With its focus on stability, safety, and efficiency, Crisalion is betting on markets like the UAE, where agile regulations and deep pockets offer a faster path to adoption.

Not all players were so lucky. Vertical Aerospace narrowly avoided disaster with a bailout from Mudrick Capital, trading 70% equity for another shot at survival. Meanwhile, Germany’s Lilium, once the belle of the eVTOL ball, filed for insolvency, undone by unsustainable burn rates and a lack of government backing. Lilium’s collapse isn’t just a company failure; it’s a warning sign for Europe, where fragmented support for high-risk innovation threatens its place in the global mobility race.

The hard truth? Building this industry is an Everest-level climb. Certifying and scaling an eVTOL could cost upwards of $2 billion per aircraft. Batteries are expensive, pilots are essential, and public trust isn’t guaranteed. Even U.S. heavyweights like Joby Aviation and Archer Aviation, backed by titans like Toyota and Stellantis, admit profitability is years—if not decades—away. They’re hedging their bets by targeting Middle Eastern markets, where friendly regulators and ready infrastructure provide a lifeline.

This leaves the eVTOL sector in a paradoxical position: it must demonstrate the viability of its vision now, while the economics and infrastructure required for sustainable scaling may not align until much later. The lingering question remains: is this a 2028 market, or is the industry racing ahead of a timeline reality cannot support?

The stakes are high. Success could revolutionize urban mobility, reducing congestion and emissions while unlocking new frontiers of transportation. Failure, however, could make eVTOLs a cautionary tale of ambition outpacing fundamentals—a stark reminder that dreams of flying cars are as much about patience and execution as they are about innovation.

💡Final thoughts on Chapter 4: Building Resilience at the Edges

2024 was not just a chapter in the ongoing story of deep tech; it was a recalibration. As we close this final section of our series, the recurring themes—resilience, ingenuity, and tension—stand out as the fabric binds this year’s advancements together. From agriculture’s transformation into a climate-resilient backbone to reindustrialization efforts that blended ambition with pragmatism, the year’s challenges underscored one truth: building in deep tech is as much about navigating complexity as it is about innovation.

This chapter examined the edges where these forces collide. It’s here, at the margins of climate volatility, geopolitical fragmentation, and economic restructuring, that the most important lessons were learned. Vertical farms and invisible fibers tackled food insecurity head-on but faced scaling constraints that tested their models. Reindustrialization attempted to tether economic sovereignty to dual-use technologies, but the sheer weight of building factories proved a formidable challenge. Robots worked their way into factories and fields alike, reshaping labor and logistics. And mobility evolved cautiously, as the sector faced harsh realities about its financial and operational fragility.

The takeaway? Deep tech doesn’t thrive in isolation. It thrives in context—navigating energy costs, geopolitical divides, regulatory headwinds, and the relentless pace of market expectations. These industries reminded us that innovation is as much about solving real-world bottlenecks as it is about dreaming big.

🤔 Reflections on 2024: The Framework of Forces

Across this series, we mapped the gravitational pulls shaping deep tech. We followed the money, traced the geopolitics, and dissected the tension between velocity and stability.

Chapter 1 - A Year in Data : Broke down 50 metrics that revealed the anatomy of deep tech’s transformations. AI dominated, but data showed the hidden cracks in its foundation and the opportunities in overlooked sectors.

Chapter 2: Spotlighted the friction between AI mania and the energy, supply chain, and industrial sectors that fought to keep pace. It explored how geopolitical urgency reshaped priorities and how ambition often outstripped execution.

Chapter 3: Delved into the intersection of public and private interests, showing how regulatory frameworks, defense contracts, and sustainability mandates set the boundaries for innovation.

Chapter 4: Brought us full circle, revealing how foundational sectors worked not to steal the spotlight but to ensure the stage itself stayed standing.

Through these chapters, a picture emerges: 2024 wasn’t just a year of building; it was a year of rebuilding. It was about recalibrating to new realities, adapting strategies to geopolitical currents, and learning that scaling isn’t just a technical challenge—it’s a human one.

🔮 A Path Forward: 2025’s Opportunity

As we step into 2025, the question isn’t whether deep tech will continue to grow—it’s how it will evolve to meet the demands of a more fragmented and fragile world.

For founders, this means embracing the grit of execution. 2024 was a reminder that resilience and pragmatism often trump flashy narratives. Success will belong to those who master not just technology but the ecosystems they operate within—navigating supply chains, securing capital, and building in alignment with regulatory and geopolitical trends.

For investors, the lesson is in balance. AI’s gravitational pull is undeniable, but the most transformative opportunities may lie in the industries that quietly underpin it. Agriculture, advanced materials, and robotics aren’t the sideshow; they’re the main event for a future that demands stability and scale.

For operators, the work is to bridge vision with reality. Scaling a GigaFarm, building a domestic battery supply chain, or deploying microreactors isn’t just about funding or innovation—it’s about logistics, partnerships, and execution.

In this sense, deep tech isn’t just about technology. It’s about context. It’s about understanding that innovation doesn’t exist in a vacuum—it exists within the currents of geopolitics, market forces, and environmental imperatives.

If 2024 was about navigating extremes—unprecedented funding, monumental failures, and transformative successes—then 2025 will be about integrating the lessons learned into a more cohesive, deliberate strategy for building the future.

This concludes our 2024 retrospective. But the work doesn’t end here—the future of deep tech is being built every day.

Let’s build better.

Remember, this is part of a series!

This chapter is part of a broader series reflecting on the trends, challenges, and opportunities that shaped 2024 for deep tech startups and venture capital.

Explore the full series with the links below: