Deep Tech Briefing #46: Weekly Insights on Deep Tech Startups and Venture Capital.

⚡ Helion's Fusion Frontier; 🪐 AI-driven Mineral Exploration; 🚀 Hypersonic Weapons; 🛸 Fuel Stations of Space; 📉 Andreessen Horowitz Shutting Down Its London Office and More...

You’re receiving Deep Tech Briefing for free.

To enjoy the full experience, become a Premium Member! The Scenarionist Premium is designed to make you a better Deep Tech Founder, Investor, and Operator. Premium members gain exclusive access to unique insights, analysis, and masterclasses with the wisdom of the world’s leading Deep Tech thought leaders. Invest in yourself, and upgrade today!

Dear Friends,

From nuclear breakthroughs to alternative proteins and hypersonic defense, deep tech is weaving itself into every corner of our economy. In energy, we’re seeing robust interest in both traditional nuclear modernization (like Rolls-Royce’s £9B deal to support the Royal Navy’s submarine fleet) and novel approaches (like Hexana’s €25M for sodium fast reactors). In climate solutions, big corporations like Microsoft are doubling down on carbon offsetting with partnerships such as Chestnut Carbon’s reforestation deal.

Meanwhile, defense tech has exploded onto the scene, fueled by a wave of interest in AI-driven autonomy, hypersonic weapons, and advanced space capabilities. We’ve also witnessed a radical shift in venture capital geographies: Andreessen Horowitz closing its London office has spurred questions about the UK’s future as a tech hub, while new funds, such as Joe Lonsdale’s 8VC seeking $1B, demonstrate that large pools of U.S. capital are hungry for disruption.

And then there’s the AI puzzle: from Reid Hoffman’s $24.6M for an AI cancer-research startup to hedge funds reportedly pausing U.S. AI bets amid China’s discount models, investors remain bullish—but cautious.

The upshot? Across fusion, food tech, and frontier defense, deep tech investment continues to accelerate, fueled by a belief that the biggest returns will come from solving the hardest problems.

Let's dive in :)

In Today's Briefing

The Big Idea – Helion's Fusion Frontier

The Deep Dives – A deep look at AI-driven mineral exploration, reusable spaceplanes, AI-powered drug discovery, hypersonic weapons, asteroid mining, and next-gen military planning

Hidden Gems – Taking a closer look at emerging companies bringing groundbreaking innovations to deep tech as next-gen nuclear, modular satellites for remote regions, and AI-driven automation for small businesses.

Quick Hits – Brief but powerful updates on funding headlines, emerging pilots, and VC shake-ups

Scenarios and Implications – Evaluating potential game-changing outcomes from a16z’s London exit, Microsoft’s carbon bet, Rolls-Royce’s nuclear deal, hedge funds pulling back on U.S. AI, and Shield AI’s $5B valuation.

Interesting Reading – A curated selection of must-read pieces for forward-thinking minds.

This Week on The Scenarionist – DeepSeek's impact on deep tech evaluation, In-Space Manufacturing, deep tech policy shifts, and more...

✨ For more, see Membership | Partnership | Deep Tech Catalyst

The Big Idea: Helion's Fusion Frontier

When fusion startup Helion first planted its flag in Everett, Washington, few imagined it would attract some of the biggest names in tech and finance. Yet here we are: Sam Altman, SoftBank, and Lightspeed Venture Partners have all joined a new, $425 million round—nudging Helion’s valuation north of $5 billion. Not bad for a company chasing what many call the Holy Grail of clean energy: fusion power.

Here’s the core of Helion’s approach. Instead of burning fossil fuels or splitting atoms (fission), Helion aims to merge deuterium and helium-3 at staggering temperatures—over 100 million degrees Celsius—in a prototype reactor named Polaris. The idea? Generate more energy than the system consumes and do so without the radioactive waste tied to conventional nuclear power. Critics say it’s a far-fetched dream, pointing to the industry’s decades of unmet promises. But Helion’s CEO, David Kirtley, is steadfast, calling it “the product the world needs,” especially for data centers fueling AI’s ravenous appetite.

That appetite is one reason Microsoft signed an agreement to buy 50 megawatts of Helion’s future output. Indeed, fusion’s appeal is clear: an “always-on” source of carbon-free electricity that, if it works, puts wind and solar to shame in terms of reliability. Of course, there’s a big “if” in the room. Even with a strong track record—like their predecessor prototype, Trenta, hitting that crucial 100 million-degree milestone—Helion still faces massive technical challenges. Heating plasma to fusion conditions is one thing; keeping it stable and generating continuous net electricity is quite another.

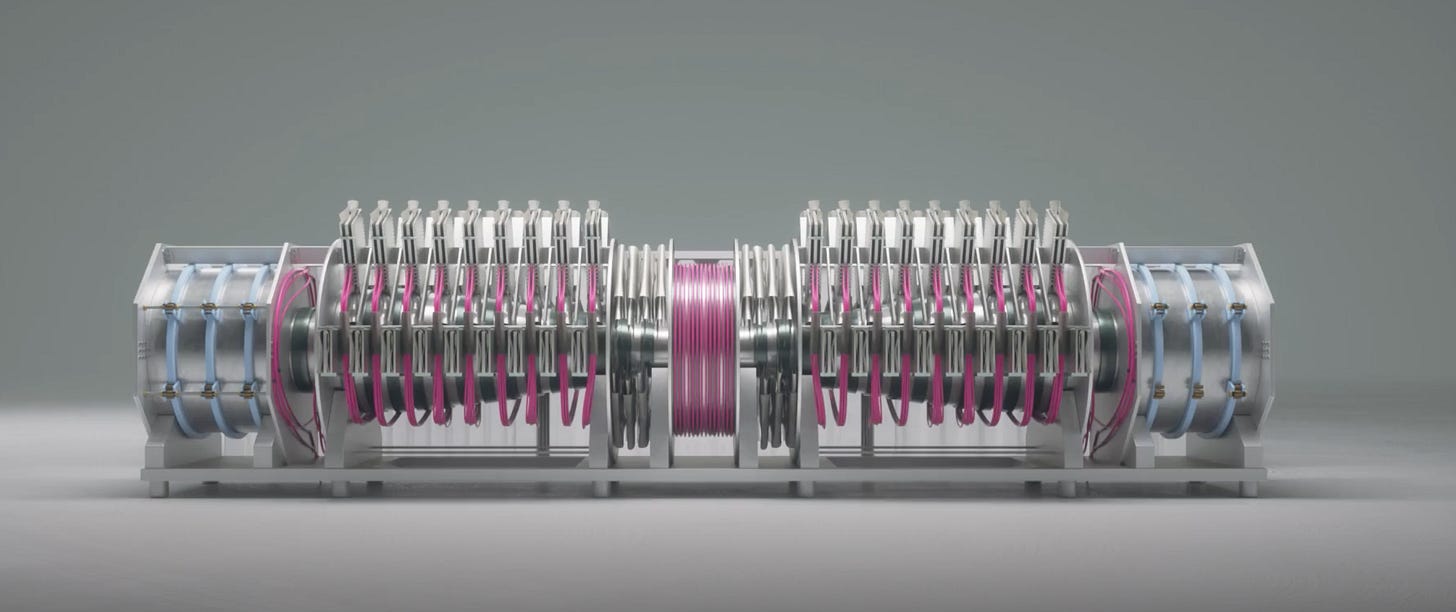

Yet Helion’s confidence is bolstered by some telling numbers. With more than $1 billion raised to date and a staff of about 450 employees, the company isn’t short on ambition. Polaris, its seventh-generation fusion device, commenced operations last year, creating the plasmas essential for fusing light atoms. Helion’s “magneto-inertial” method compresses plasma at speeds of over 1 million miles per hour, aiming to capture electricity directly from the reactor’s pulsing magnetic fields—no steam turbine required. The ultimate plan? Deliver base-load, 24/7 clean power for everything from AI clusters to steelmaking: in fact, Nucor has inked a deal for a future 500-megawatt fusion reactor by 2030.

Helion’s internal manufacturing push (including building its own capacitors and high-powered magnets) suggests they’re serious about scaling. Whether the skeptics prove right or Helion truly ushers in a new era of commercial fusion, the stakes couldn’t be higher. If this technology works at scale, “Everett, Washington” might just become the next big name in our global energy playbook.

The Deep Dives

🔸Earth AI raises $20M to scale AI-driven mineral exploration

Earth AI has closed a an oversubscribed $20 million Series B to scale its AI-driven mineral exploration system. The round was led by Tamarack Global and Cantos Ventures, with backing from Overmatch, Alpaca, Sparkwave Capital, Y Combinator, and Scrum Ventures.

The demand for nickel, lithium, and copper is surging as industries expand energy storage and electrified infrastructure. The International Energy Agency estimates lithium demand could rise 13x to 51x by 2040, while copper shortages could reach 10 million metric tons annually by 2030.

Earth AI’s platform identifies high-probability deposits before drilling, reducing reliance on traditional costly and slow field surveys. The company’s approach contrasts with Kobold Metals, which conducts multi-layered geological scans, by prioritizing faster scanning over broad areas.

Since launching exploration in Australia, Earth AI has made four confirmed mineral discoveries and operates on a royalty-based model, partnering with license holders or selling mining rights.

This funding follows $18 million in prior capital, including a $5.8 million SAFE round in early 2024, positioning Earth AI to scale operations as global supply constraints on industrial metals tighten.

🔸Dream Chaser passes key NASA test, moves closer to ISS mission

Sierra Space’s Dream Chaser spaceplane successfully cleared NASA’s Joint Test 10B, a critical milestone ahead of its first ISS resupply mission. The test, conducted at Kennedy Space Center, validated Dream Chaser’s ability to power scientific payloads, regulate environmental conditions, and transmit real-time data to control centers.

The demand for faster, reusable cargo transport to the ISS is rising as space-based research expands. Unlike capsule-based spacecraft that splash down at sea, Dream Chaser’s runway landing capability enables rapid retrieval of time-sensitive experiments—potentially cutting down delays from days to hours.

Dream Chaser’s latest test focused on three key payloads:

Polar, a cryogenic storage unit preserving biological samples at temperatures between -95°C and +10°C, developed by the University of Alabama at Birmingham and managed by NASA’s Cold Stowage Lab.

PAUL (Powered Ascent Utility Locker), a Space Tango-built module that provides continuous power to microgravity research experiments during ascent, supporting biomedicine and advanced materials studies.

NASA’s Single Stowage Locker, a standardized system for transporting scientific instruments and hardware to the ISS.

Dream Chaser’s ability to land on a runway instead of splashing down at sea gives it an advantage over traditional cargo spacecraft. Fragile biological experiments and high-value research can be retrieved within hours instead of waiting days for ocean recovery and transport. That speed could make a difference for industries looking to leverage microgravity for advanced R&D.

🔸Reid Hoffman Raises $24.6 Million for AI-Driven Drug Cancer Research

AI is reshaping drug discovery, and Manas AI is the latest biotech startup to capitalize on the shift. Co-founded by Reid Hoffman and cancer researcher Siddhartha Mukherjee, the company is launching with $24.6 million in seed funding from Hoffman, General Catalyst, and Greylock. The first targets: breast cancer, prostate cancer, and lymphoma, which collectively account for 38% of all new cancer diagnoses in the U.S. each year.

Manas AI is running its models in Microsoft’s cloud data centers, training AI systems to analyze vast biological datasets. The goal: reduce the staggering 90% failure rate in drug development, where most candidates never make it past clinical trials. Traditional R&D costs can reach $2.5 billion per drug and take over a decade to complete. AI-powered simulations promise to identify viable compounds faster, cutting both time and costs.

Unlike many AI-biotech firms that partner with pharmaceutical giants, Manas AI plans to develop and commercialize its own drugs, betting that proprietary drug pipelines will be more valuable than licensing deals.

AI-driven drug discovery startups raised $3.34 billion in 2024, up 5x from 2023, per PitchBook. The sector includes deep-pocketed players like Google’s Isomorphic Labs, but no AI-designed drug has yet secured FDA approval. Manas AI is positioning itself to be among the first to change that.

🔸SpaceX veterans' hypersonic weapons startup, Castelion, Strikes $100M Series A

Silicon Valley’s push into defense tech continues as Castelion, a hypersonic missile startup, secures $100 million to accelerate manufacturing. The company raised $70 million in equity from Lightspeed Venture Partners, a16z, Lavrock Ventures, and First In, plus $30 million in venture debt from Silicon Valley Bank.

The U.S. military has struggled to deploy hypersonic systems, even after spending billions over the last decade. China’s Mach 20 hypersonic test in 2021 raised alarms in Washington, leading to renewed urgency in developing similar technology.

Castelion, founded by former SpaceX engineers, believes it can solve the problem with high-cadence testing and vertical integration. The company conducts regular missile tests in California, designs and manufactures its own solid rocket motors and electronics, and is investing in a new factory in Texas to increase production.

The startup has already been awarded $22 million in Air Force contracts, with its first hypersonic test flight scheduled for this summer. Castelion says its approach will result in a lower-cost, mass-producible alternative to systems currently in development by major defense contractors.

As demand for high-speed, maneuverable weapons grows, Castelion is part of a broader shift in defense procurement, where the Pentagon is looking beyond legacy contractors to new entrants with rapid development cycles.

🔸 AstroForge reveals first asteroid target, signs launch deal for mining missions

AstroForge’s Odin spacecraft is set to launch February 26, heading to asteroid 2022 OB5 in what could be the first step toward commercial asteroid mining. The spacecraft will conduct a 300-day flyby, capturing high-resolution images and sending back data to determine the asteroid’s metal content.

NASA estimates that the total value of metals in near-Earth asteroids exceeds $100 trillion, with individual asteroids potentially worth $10 trillion or more. AstroForge, which raised $40 million in a Series A last year, believes it can extract these materials at a fraction of historical costs. Unlike previous government-backed asteroid missions that cost hundreds of millions, Odin’s mission is budgeted at just $6.5 million.

To scale up, AstroForge has signed a multi-launch agreement with Stoke Space, which recently secured $260 million in funding for its fully reusable Nova rocket. The deal will allow AstroForge to conduct multiple missions with direct asteroid insertion, reducing reliance on fuel-heavy slingshot maneuvers.

AstroForge’s goal is to prove that space mining is economically viable. If its low-cost, high-frequency model works, it could disrupt an industry where most companies are still focused on theoretical extraction models rather than real-world missions.

🔸 Onebrief reaches $650M valuation and announces board appointment of Chris Miller

Onebrief, a developer of advanced military planning architecture, has secured $50 million in Series C funding, pushing its valuation to $650 million. The round was led by General Catalyst and Insight Partners, with participation from Caffeinated Capital, Human Capital, and 9Yards Capital. The company also announced that Chris Miller, former acting Secretary of Defense, has joined its board.

For years, the Pentagon has relied on static mission planning systems that require weeks of adjustments. Onebrief’s platform enhances real-time operational coordination, reducing planning cycles by up to 95%. In a recent military exercise, a combat unit used Onebrief to complete a full mission restructuring in under three hours—a task that previously took weeks.

The U.S. defense budget for decision intelligence and automation is expected to hit $15 billion by 2025, reflecting a broader shift toward adaptive command frameworks. Onebrief’s platform is already used across all major combatant commands, integrating into classified operational networks.

Miller, an advocate for adaptive defense infrastructure, sees Onebrief as a foundational element in next-generation military operations. His addition to the board reinforces Onebrief’s positioning as a key enabler of the Pentagon’s shift to dynamic, data-driven operational planning.

Hidden Gems

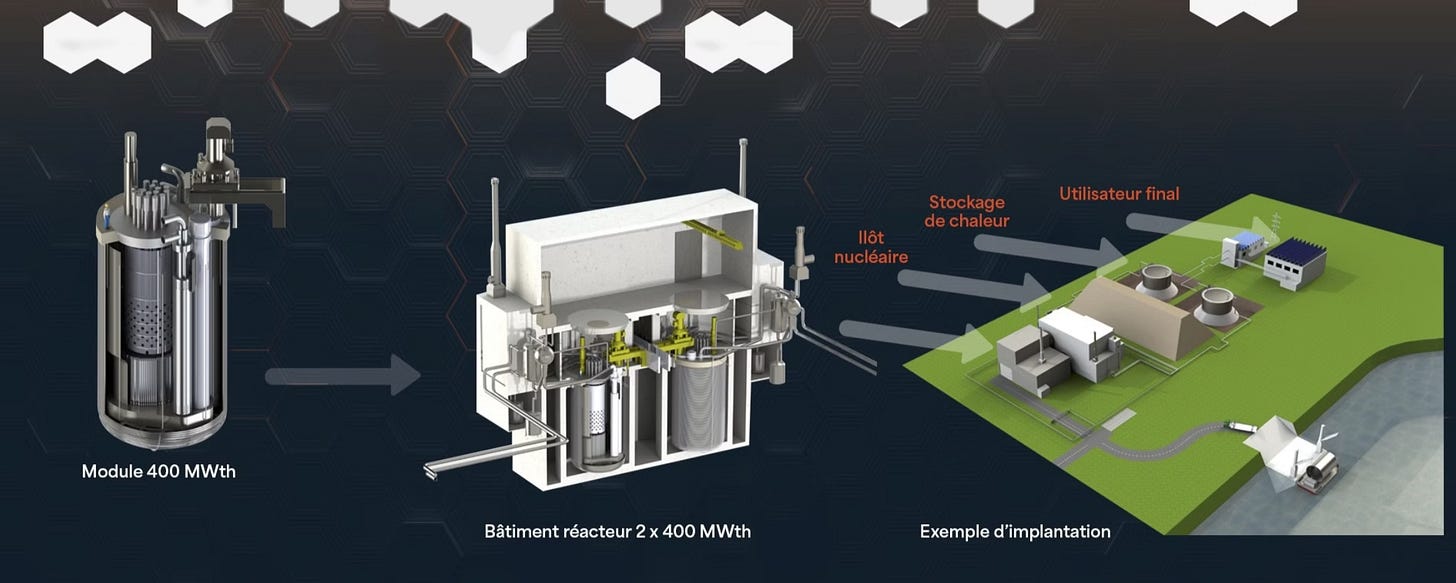

🔹Hexana: Reviving a Forgotten Nuclear Tech for Industrial Heat

What they do: French startup Hexana is reviving an old but promising nuclear technology—sodium-cooled fast reactors (SFRs)—to decarbonize heavy industry and provide reliable heat at scale.

The tech: Hexana’s platform features modular 400 MWt sodium fast reactors, integrated with thermal storage, enabling high-temperature heat delivery, flexible power generation, and the production of industrial process steam.

Why now?: France shut down its last sodium-cooled reactor in 2009, and its ambitious ASTRID project was scrapped in 2019. But with nuclear making a slow comeback in Europe and the U.S., there’s renewed investor interest in commercializing this underutilized but proven technology.

The business case: Industrial sectors need alternatives to gas-fired heat. Hexana argues its reactor system is cost-competitive with gas while offering stable, on-demand power, making it a potential game-changer for heavy industry decarbonization.

Funding & backers: €25M in new funding, including Bpifrance, Blast.Club, and Eren Industries, to move from conceptual design to the basic design phase. Next steps include securing regulatory approval and landing its first industrial customers.

The risk factor: Sodium-cooled fast reactors have a troubled history—abandoned by France, the U.S., and Germany decades ago. The real question: Can Hexana convince both regulators and industrial clients that it has solved the issues that derailed its predecessors?

The competitive landscape: Fast reactors are not new, but their commercial success has been elusive. Players like TerraPower (backed by Bill Gates) and ARC Energy are developing similar technologies in the U.S. and Canada, but Hexana believes it holds a regulatory advantage in Europe thanks to France’s nuclear heritage.

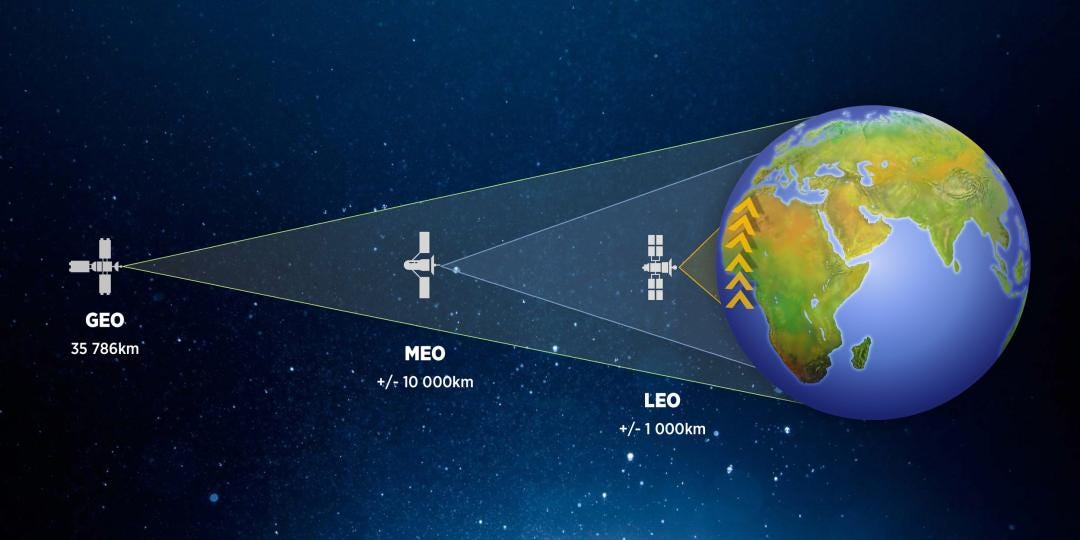

🔹 AscendArc: Betting on Small GEO Satellites

What they do: AscendArc, a Portland-based startup, is developing small, mass-produced geostationary (GEO) satellites to provide high-bandwidth communication solutions for both military and commercial markets, challenging the dominance of LEO constellations.

The tech: The company’s sub-1,000 kg GEO satellites offer continuous coverage at a tenfold reduction in cost per megabit compared to traditional GEO systems, making them a cost-effective alternative to fiber and microwave in underserved areas.

Why now?: With LEO constellations gaining traction, AscendArc’s GEO satellites provide a scalable, low-cost solution for rural and remote areas, alongside meeting the growing military demand for secure, reliable communication.

The business case: AscendArc’s low-cost manufacturing and quick deployment allow for fixed, uninterrupted coverage, reducing the need for massive satellite fleets and expensive handovers in commercial and national security markets.

Funding & backers: AscendArc raised $4M from investors like Seraphim Space and Everywhere Ventures, plus a $1.8M U.S. Air Force STTR contract. The company is focused on production readiness and regulatory approval for both military and commercial applications.

The risk factor: While GEO tech is well-established, AscendArc's focus on small, scalable satellites brings uncertainty about military adoption and whether the company can scale quickly to meet growing demand.

The competitive landscape: Competing with Astranis and others, AscendArc’s advantage lies in its mass-production and cost-efficient deployment—but success will depend on delivering its promising tech and meeting the market’s evolving needs.

🔹Metafuels: Pioneering Affordable e-SAF Production for Aviation

What they do: Metafuels, a Swiss startup, is developing a cost-effective solution to produce sustainable aviation fuel (e-SAF) by converting e-methanol into jet fuel using a renewable, efficient process.

The tech: Metafuels uses methanol synthesis to produce e-SAF with 50% lower costs and 80% higher yields than traditional methods, offering a competitive advantage in the growing decarbonized aviation fuel market.

Why now?: With airlines under pressure to meet carbon neutrality goals, the demand for affordable SAF is rising. Metafuels provides a scalable solution to help airlines reduce emissions and reach sustainability targets.

The business case: Currently producing e-SAF at its pilot plant (1 liter/day), Metafuels plans to scale to 12,000 liters/day by 2028, targeting significant market share in aviation decarbonization.

Funding & backers: $22M raised, including a $9M recent round led by Celsius Industries, with participation from RockCreek, Fortescue Ventures, Verve Ventures, with existing investors Energy Impact Partners (EIP) and Contrarian Ventures.

The risk factor: Scaling e-SAF production at competitive prices while meeting industry standards is a challenge. Metafuels must prove it can scale efficiently and deliver on cost savings.

The competitive landscape: While competing with Neste and World Energy, Metafuels’ methanol-based processoffers a cost-effective, higher-efficiency alternative, positioning it as a potential disruptor in the e-SAF market.

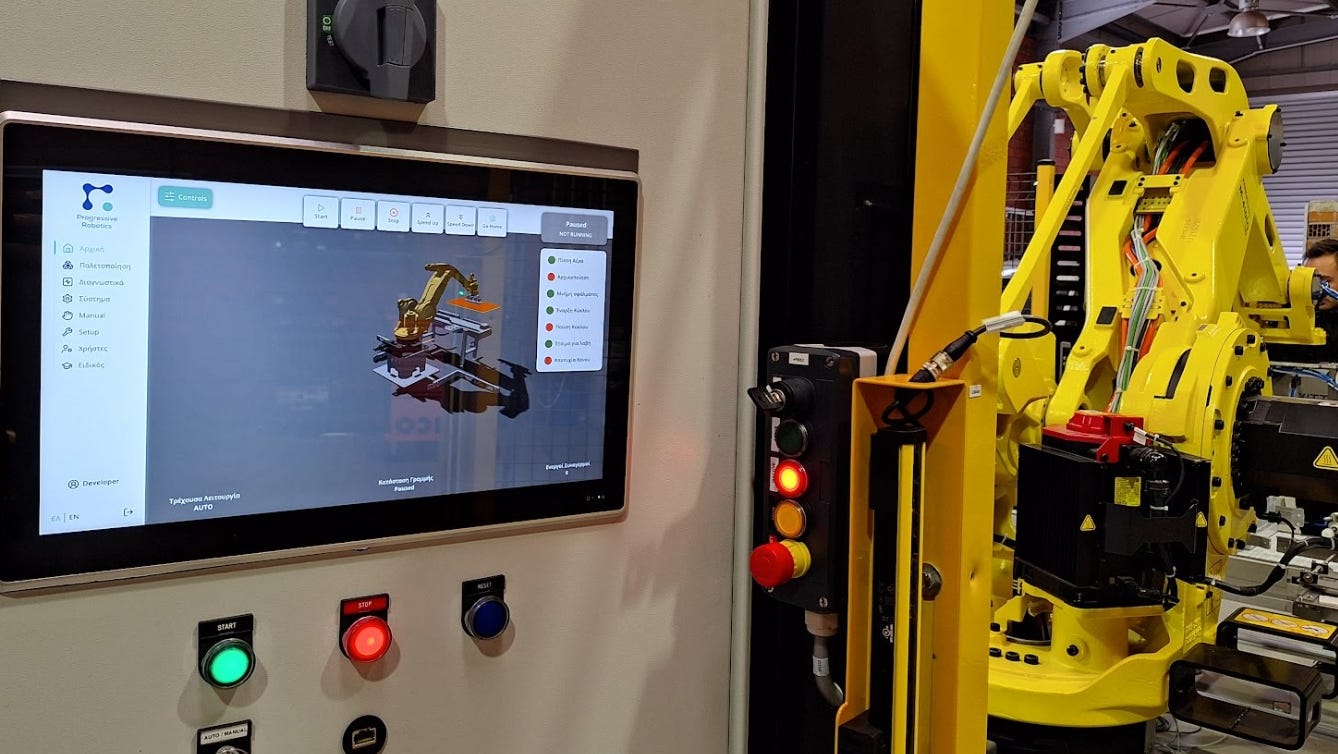

🔹Progressive Robotics: Making Robots Smarter

For Manufacturing & Logistics

What they do: Progressive Robotics, a Greek startup, is making robotic automation accessible to SMEs with an AI-driven, no-code platform, allowing businesses to deploy robots without technical expertise.

The tech: Its drag-and-drop interface enables easy robot configuration, while its AI-powered palletizer optimizes warehouse logistics in real time.

Why now?: With labor shortages and supply chain challenges, demand for affordable automation is rising. Progressive Robotics eliminates the need for costly system integrators, making robotics adoption feasible for small businesses.

The business case: SMEs have been underserved in automation. The company claims its AI-driven robots boost efficiency by 20%, with early traction in food, logistics, and manufacturing.

Funding & backers: Raised €1.55M from Marathon Venture Capital and Genesis Ventures to scale operations and expand internationally.

The risk factor: Competing with enterprise-grade robotics, the challenge is proving scalability while maintaining ease of use. SME adoption will be key.

The competitive landscape: While Nvidia and ABB focus on large-scale automation, Progressive Robotics is targeting SMEs—a market poised for high growth if barriers to adoption are removed.

🔹Spaceium: Building the Fuel Stations of Space

What they do: Spaceium, a Y Combinator-backed startup, is developing in-space refueling stations, enabling spacecraft to extend missions, carry larger payloads, and reduce costs—critical steps toward a sustainable space economy.

The tech: Spaceium’s system includes cryogenic fuel storage tanks capable of long-term fuel preservation and robotic arms for in-orbit refueling. These gas stations in space could drastically change how spacecraft operate in LEO, GEO, and deep space.

Why now?: Space travel is expanding, but spacecraft still rely on launching with all their fuel upfront, limiting missions and increasing debris. Lower launch costs have opened the door for orbital refueling to become a scalable business.

The business case: Spaceium aims to extend satellite lifespans and enable deep-space exploration, with early commercial interest in its 2027 refueling station launch. Investors see this as a critical step toward building a space logistics network.

Funding & backers: Closed a $6.3M oversubscribed seed round, led by Initialized Capital, alongside Y Combinator, Olive Tree Capital, and others. Funds will support an in-orbit refueling demo this year.

The risk factor: Orbit Fab and Astroscale are already competing for space refueling dominance, and government partnerships will be key. Spaceium must prove its tech works in orbit and differentiate itself with its proprietary long-term fuel storage system.

The competitive landscape: Orbit Fab has a head start, and Astroscale won a $25.5M U.S. Space Force contract, but Spaceium’s advantage lies in fuel preservation tech. If it delivers, it could become a critical enabler of long-haul space infrastructure.

Quick Hits:

Ÿnsect, a leader in insect farming for protein production, is exploring all possible options, including a potential third-party takeover, while rival Agronutris has filed a safeguard plan with the court. The shake-up in the insect-ag sector raises big questions about the economic viability of large-scale insect farming. 🔗

Veir just secured $75 million to pilot its superconducting power transmission tech in data centers. As AI workloads surge and GPUs devour power, this could be a game-changer for reducing energy loss and improving efficiency. 🔗

MIT physicists have made a historic leap by measuring quantum geometry for the first time. This breakthrough could reshape our understanding of quantum materials and lead to advancements in everything from superconductors to quantum computing. 🔗

Lufthansa and Germany’s Aerospace Center (DLR) are tapping into quantum computing to optimize airline operations. With flight planning riddled with real-time variables, quantum algorithms could unlock major efficiency gains in the industry. 🔗

A UK startup is deploying modular data centers powered by biogas, sidestepping traditional grid constraints. The result? A 44% cut in energy costs and a 70% drop in emissions, making a strong case for sustainable computing. 🔗

ConductorAI, a defense-tech startup specializing in AI-driven compliance automation, is relocating its HQ to Maine. The move positions it closer to key government and private-sector clients while leveraging the state’s growing engineering talent pool. 🔗

A new venture capital alliance in Beverly Hills is aiming to create the next tech powerhouse hub. With a focus on deep tech and disruptive innovation, the initiative could pull high-impact startups into the ecosystem. Worth watching to see if Hollywood’s money can fuel the next Silicon Valley. 🔗

Scenarios and Implications

Andreessen Horowitz Exits London – A Tactical Shift or a Market Signal?

Andreessen Horowitz is shutting down its London office just a year after its expansion, citing no change in its European investment strategy. Is this a reflection of shifting capital efficiency priorities, a sign that local presence is no longer essential, or an indication that Europe's venture landscape isn’t delivering expected returns? Either way, it raises questions about the future of global VC footprints and the evolving balance between sector-driven vs. geography-driven investing.

🚀 Opportunities: More focus on sector expertise over geographic expansion; regional funds may gain ground; startups with clear defensibility may benefit from capital redeployment.

⚠ Challenges: Less on-the-ground investor engagement; increased competition for global capital; founders may need to rethink access to non-local VC.

Microsoft’s Carbon Credit Bet – Market Validation or Regulatory Hedge?

Microsoft has signed a major carbon credit deal with Chestnut Carbon, reinforcing its role in shaping the voluntary carbon market. Is this a genuine long-term bet on carbon removal, a hedge against impending regulation, or an early attempt to establish pricing power in an emerging asset class? As more corporates enter, the carbon economy is evolving from an ESG tool to a strategic necessity.

🚀 Opportunities: Demand for verification, tracking, and financial instruments; startups in engineered carbon removal may attract more corporate partnerships.

⚠️ Challenges: The market remains fragmented and speculative; regulatory shifts could disrupt existing business models; credibility concerns over scalability and permanence.

Rolls-Royce Secures £9B for Nuclear Submarines – Deep Tech at an Inflection Point?

The UK government’s investment in Rolls-Royce’s nuclear propulsion program signals a broader trend: deep tech, particularly in energy and autonomy, is increasingly state-funded. Is sovereign-backed capital becoming the primary driver of foundational technology? And if so, how will this reshape venture-scale opportunities?

🚀 Opportunities: More public-private partnerships in energy, AI, and advanced materials; sovereign investment could provide long-term stability for frontier tech.

⚠️Challenges: Bureaucratic complexity and policy risks; limited participation for non-incumbents; increased ethical scrutiny on defense-related tech.

Hedge Funds Pull Back from U.S. AI as DeepSeek Gains Ground

Goldman Sachs reports that hedge funds are slowing AI investments in the U.S., just as China’s DeepSeek AI gains traction. Is this a rational cooldown after a hype cycle, or a sign that AI capital is shifting toward commercial applications over foundational models? And as global competition intensifies, how much will investment be shaped by geopolitics rather than just technical merit?

🚀 Opportunities: Stronger focus on AI monetization and vertical applications; increased demand for AI compliance, security, and governance solutions.

⚠️ Challenges: Regulatory uncertainty could slow investment; capital may consolidate around fewer players; geopolitical barriers could limit cross-border scaling.

Shield AI Hits $5B – Is Defense Tech the Next Major Venture Market?

Shield AI’s $5 billion valuation suggests defense autonomy is no longer a niche play but a serious venture-backed category. Is this a structural shift toward national security-driven investment, or is current momentum tied to geopolitical uncertainty? Either way, it cements defense tech as an increasingly relevant sector for capital and innovation.

🚀 Opportunities: Growing demand for AI, autonomy, and cybersecurity; increased government-backed fundingcould provide stability for deep tech startups.

⚠️ Challenges: Tighter export controls and policy risks; reputational concerns around military applications; long sales cycles in defense procurement.

Interesting Reading

OpenAI launches ChatGPT Gov for U.S. government agencies

OpenAI is extending its reach into the public sector with ChatGPT Gov, a tailored AI for government use. A strategic move that not only broadens AI adoption but also strengthens ties with policymakers—an increasingly important dynamic in today’s regulatory climate.

Trump says Microsoft is in talks to acquire TikTok –

The idea of Microsoft acquiring TikTok is back, reviving discussions on data security, geopolitics, and Big Tech’s influence. Whether this deal materializes or not, it signals how critical the intersection of technology and policy has become.

The Download: climate tech under Trump, and scaling up quantum computing

Two sectors at inflection points: climate tech, navigating evolving policy landscapes, and quantum computing, steadily moving from theory to scale. Both hold vast potential, but with vastly different paths ahead.

Intuitive Machines delivers second lunar mission lander to Cape Canaveral

Private space exploration continues to accelerate, with Intuitive Machines delivering another lunar lander. A reminder that the next phase of space activity will be increasingly shaped by commercial players.

The DeepSeek Story: Implications for Deep Tech AI Valuations

The Chinese AI startup is proving that cutting-edge models don’t always require massive capital. Does this challenge prevailing investment assumptions, or is it an exception? A question worth considering.

This Week on The Scenarionist

Share Deep Tech Briefing and Get Rewarded 🎁

Invite your friends to subscribe using your referral link or the "Share" buttonon any post. The more friends you bring in, the more exclusive perks you unlock!

HOW IT WORKS:

✅ 5 referrals → 1 month of Premium FREE

✅ 10 referrals → 3 months of Premium FREE

✅ 25 referrals → 6 months of Premium FREE

Start sharing now & earn rewards while spreading Top-Quality Deep Tech Insights!